You have to appear positive and act like you know what you're carrying out in order to acquire a seller's trust. It helps to have a portfolio of houses you've currently offered so you can persuade them that discovering a purchaser will be no problem. Using the ideal cost becomes part of this art also. If you go too low, the seller may end up being careful and decline your offer. If you go too high, you risk of reducing or even losing your earnings. It's all a delicate balance. The great news is that it typically ends up being force of habit after you get some experience.

Keep in mind that you're attempting to make a revenue, so the price you offer them will be higher than the price you have actually provided the seller. Wholesaling becomes a lot easier when you have actually dealt with certain investor on a regular basis. Much of them will concern depend on you to discover offers, but until that point, a prospective purchaser might desire to see the property themselves or send an agent, like a home inspector, to inspect it out. You'll require to factor this into the contract and avoid the seller and buyer from linking over your headwhich can be done using a trust (more on that later).

A wholesale trust resembles a land trust. A land trust, or any kind of trust, is when properties are placed in the care of a steward, like a lawyer. In the case of wholesaling property, a land trust is a legal tool that helps a wholesaling offer go a lot smoother. While the procedure of finding a determined seller, setting up a purchase contract, and after that passing that contract along to an end purchaser sounds excellent, the truth is that numerous states limit the process of reassigning a contract. The way to get around this problem is to have your wholesale trust buy the residential or commercial property.

By doing this, there is no two-step procedure of creating a contract and after that reassigning it to another buyer. While land trusts can turn the act of a wholesaling offer into a wholesale realty organization, developing a trust is an intricate procedure that varies from state to state and ought to be set up by a skilled legal advisor. Wholesaling real estate might be described as the fast-food of real estate investing. It's quickly, easy, and bears none of the problems of funding a home, fixing it up, or managing occupants. All you need to do is find people who desire to offer their house quickly, lock them into a contract, and find a buyer.

It really takes a great deal of research and networking, which lots of individuals will have a hard time to do. But for those who take pleasure in finding deals and getting in touch with other financiers, the possibilities are limitless.

Last Upgraded on February 24, 2019 by Mark Ferguson, You can make a lot of cash in real estate by wholesaling houses, however it is not easy. Numerous masters like to teach wholesaling as an easy way to get abundant with no money to start. It can be a fantastic organization, but it is by no methods easy, and it usually takes a minimum of a little cash. This article reviews how wholesaling works, what you must realistically expect in business, and how to be successful. Lots of people might not recognize with what a genuine estate wholesaler does, however it is pretty easy: a wholesaler purchases and offers homes really quickly without doing any repairs, or they get a home under agreement and assign the contract to another purchaser.

Excitement About What Does Under Contract Mean In Real Estate

Honestly, the majority of people who wish to wholesale do not make a lot of money since they give up due to the hard work Browse around this site and the devotion it requires to develop a successful wholesaling service. The wholesalers who stay with timeshare san diego cancellation it, construct systems, and persevere can make millions of dollars in business. Get 96% off Rehabvaluator's No-BS Wholesaling 101 Master Class Training with this special link. Wholesaling is based on purchasing and offering homes extremely quickly without making any repair work. A wholesaler will get homes under agreement well listed below market price and then sell your homes or assign the agreements to another financier.

Almost every owner-occupied buyer will require to complete those products to get a loan, and that is why the residential or commercial properties https://daltonzjlw.bloggersdelight.dk/2021/06/08/facts-about-what-are-real-estate-taxes-uncovered/ are offered to other investors. The wholesaler does not need to utilize their own cash because they utilize what is called a double close or an assignment of agreement. When you double close, the title company will utilize the cash from the end investor to pay the initial seller so the wholesaler does not need to create the cash. When an assignment is utilized, the wholesaler simply designates the agreement they had with the seller to the end financier, and the end investor ends up being the purchaser.

/Screen-Shot-2017-03-30-at-3.34.40-PM-58dd5ec75f9b584683e64f57.png)

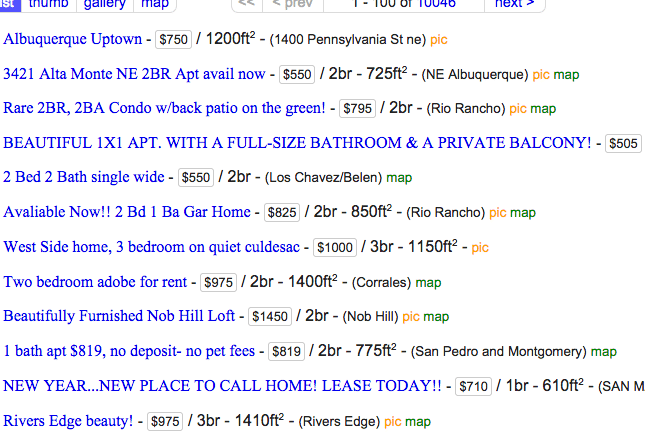

Here is how the procedure works: A common wholesaler may utilize postcards sent to absentee owners (owners who do not reside in the home) to shop the home. How is the real estate market. Absentee owners are in some cases more motivated since they do not reside in your home and might have bad tenants or no occupants. The wholesaler might likewise discover a handle numerous other methods, consisting of the MLS, auctions, driving for dollars, FSBOs, and so on. As soon as the wholesaler discovers a possible offer, they require to speak with the owner and try to get your house under contract. The wholesaler needs to know what their investor purchasers will spend for the home and get it under agreement for less than that.

Getting a home under contract means the seller and wholesaler sign a contract with all the regards to the deal. When the wholesaler has your home under contract, they need to discover a buyer for it. Wholesalers need to have a list of buyers they will send the offer to. Each wholesaler is different in how they deal with the purchasers as some will offer the home on a first come initially serve basis (whoever says they want it very first gets it) and some will have a bidding system where the highest bidder gets the deal. One of the key parts of a successful wholesaling service is finding an investor-friendly title business.

Many wholesalers need the end buyer to submit a non-refundable earnest cash deposit with their title business. If the financier backs out, the wholesaler gets that down payment (What is wholesaling real estate). The title business will make sure the residential or commercial property has a clear title (in some states you might utilize an attorney to handle this). Once a clear title is confirmed, the closing will be established, and the title company will create the documentation and schedule a day to sign. The wholesaler needs to make sure the property remains in the exact same condition as when completion buyer says it which the residential or commercial property is accessible and vacant (assuming those were the regards to the deal).